omaha ne sales tax rate 2019

Edward 07012019 15 0101200910 St. Ralston NE Sales Tax Rate.

Video Expressvote How To Vote Election Systems Software

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. You can print a 725 sales tax table here. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

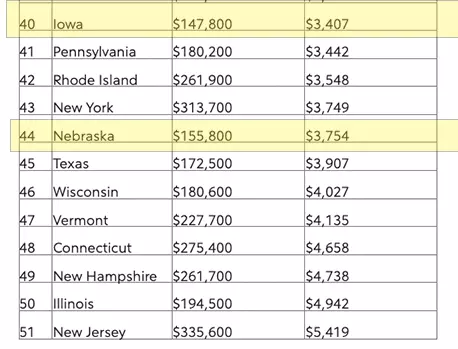

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. You can print a 7 sales tax table here. Sales Tax Rate Finder.

Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville 0401201515 1001198210 St. 05 lower than the maximum sales tax in NE. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Plattsmouth NE Sales Tax Rate. Seward NE Sales Tax Rate. Omaha NE Sales Tax Rate.

Sales Tax State Local Sales Tax on Food. Sales and Use Tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

For tax rates in other cities see Nebraska sales taxes by city and county. The local sales tax rate is 1 percent in Eagle and Greenwood. The Nebraska state sales and use tax rate is 55 055.

Alice Homan 8 of Omaha pretends to use a telephone alongside her mother Sen. Sidney NE Sales Tax Rate. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers.

Lou Ann Linehan of Elkhorn who chairs the eight-member committee spoke Monday in support of using the new revenue to reduce the states sales tax rate currently 55 and any. Request a Business Tax Payment Plan. 375 lower than the maximum sales tax in IL.

The 725 sales tax rate in Omaha consists of 625 Illinois state sales tax and 1 Gallatin County sales tax. For tax rates in other cities see Illinois sales taxes by city and county. AP Republican gubernatorial challenger Tim James on Wednesday called for a repeal of Alabamas 2019 gas tax.

There is no applicable city tax or special tax. Real property tax on median home. Scottsbluff NE Sales Tax Rate.

There is no applicable county tax or special tax. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. Nebraska Department of Revenue.

Papillion NE Sales Tax Rate. The bill requires online retailers to collect sales taxes once they have 100000 worth of sales or at least 200 transactions in Nebraska. Nebraska sales tax changes effective July 1 2019.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to. Paul 10012000 10 Sargent 04012019 20 0401201315 0101200710. Schuyler NE Sales Tax Rate.

The Nebraska state sales and use tax rate is 55 055. Close online purchasing shopping credit card black. 15 percent in Omaha Ashland Bellevue Bennington Blair Fort Calhoun Fremont Gretna Louisville Plattsmouth Ralston.

There is no applicable county tax or special tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. Sales Taxes In The United States Wikiwand Sales Taxes In The United States Wikiwand Nebraska S Sales Tax Sales Taxes In The United States Wikiwand.

Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax while the city of St. 800-742-7474 NE and IA. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

Make a Payment Only. For tax rates in other cities see Nebraska sales taxes by city and county. Offutt Air Force Base NE Sales Tax Rate.

For tax rates in other cities see Puerto Rico sales taxes by city and county. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. December 3 2018.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. You can print a 7 sales tax table here. How The County Inheritance Tax Works Nebraska S Sales Tax 2020 The Year Of The Roth Ira Conversion Lutz Financial Nebraska.

Omaha ne sales tax rate 2019 Sunday July 31 2022 Edit. Megan Hunt of District 8 during the first day of the 2019 Legislative Session at the Nebraska State Capitol in. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

The 7 sales tax rate in Omaha consists of 55 Puerto Rico state sales tax and 15 Omaha tax.

Self Employment Tax 2021 2022 Rates Calculator

Local Government Revenue Structure Trends And Challenges Semantic Scholar

Nebraska State Tax Things To Know Credit Karma

Tax News Views Minimum And Bachelor Tax Roundup

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Property Taxes Explained Omaha Relocation

2020 Nebraska Property Tax Issues Agricultural Economics

Property Taxes Explained Omaha Relocation

Sales Tax On Cars And Vehicles In Nebraska

Costco Sales Tax By State Check Sales Tax

How To Buy Your First Rental Property In Market City Rental Property Rental Property Investment We Buy Houses

Key Questions To Ask Your Tax Professional

6917 Halsey Dr Shawnee Ks 66216 Realtor Com

Local Government Revenue Structure Trends And Challenges Semantic Scholar